Continuously investing in yourself is one of the cheapest, yet greatest form of investment you can make. That's why you need to invest time and money if you want growth for yourself.

It pays to learn your lessons, especially if you gain valuable life-lessons that could cost you more when your learn them through avoidable mistakes.

So when an opportunity knocks, do you take it or make an excuse? Thankfully, we never run out of opportunities (and excuses for NOT taking them). And for those (including me) who enthusiastically attended this free Talk on Saving, Investing and Achieving Financial Wellness last April 28, 2015, we've just learned so many lessons that will help us financially move forward!

But I love to share, right? So here's a short summary (Press Release) of that seminar:

Earning money is an empowering act; managing your money well is doubly so.

During Entrepreneur Philippines’ recent ’Trep Talks, Armand Bengco, executive director of the Colayco Foundation for Education Inc., underscored that now — not yesterday, not tomorrow — is the best time to take control of your finances, and to “enjoy the fruits of an improved investment climate.”

During Entrepreneur Philippines’ recent ’Trep Talks, Armand Bengco, executive director of the Colayco Foundation for Education Inc., underscored that now — not yesterday, not tomorrow — is the best time to take control of your finances, and to “enjoy the fruits of an improved investment climate.”

It pays to learn your lessons, especially if you gain valuable life-lessons that could cost you more when your learn them through avoidable mistakes.

So when an opportunity knocks, do you take it or make an excuse? Thankfully, we never run out of opportunities (and excuses for NOT taking them). And for those (including me) who enthusiastically attended this free Talk on Saving, Investing and Achieving Financial Wellness last April 28, 2015, we've just learned so many lessons that will help us financially move forward!

But I love to share, right? So here's a short summary (Press Release) of that seminar:

Earning money is an empowering act; managing your money well is doubly so.

During Entrepreneur Philippines’ recent ’Trep Talks, Armand Bengco, executive director of the Colayco Foundation for Education Inc., underscored that now — not yesterday, not tomorrow — is the best time to take control of your finances, and to “enjoy the fruits of an improved investment climate.”

During Entrepreneur Philippines’ recent ’Trep Talks, Armand Bengco, executive director of the Colayco Foundation for Education Inc., underscored that now — not yesterday, not tomorrow — is the best time to take control of your finances, and to “enjoy the fruits of an improved investment climate.”With the Philippine economy on an upswing — given greater domestic productivity, manageable inflation, high government spending, positive trade flows, and a robust stock market — Bengco said it would be “tragic” if Filipinos, entrepreneurs and employees both, missed the opportunity to grow their hard-earned money.

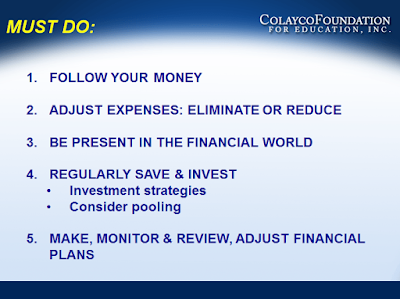

“Let’s not miss the investment train,” said 47-year-old Bengco, adding that for your investment to be good, it should have PTT: Purpose, Targeted amount, and Timeline. For one, Bengco emphasized making the most of your productive years — “your years of employment and/or operating a business of your own” — to ensure that you’ve got a healthy income to live on when you retire.

Citing figures from the National Statistics Office, Bengco noted that on average, Filipino men and women can now expect to live until the ages of 77 and 79, respectively, or more than a decade past the mandatory retirement age of 65. “How will you enjoy your dozen more years…if you haven’t managed your personal finances well?” he asked the listening crowd of entrepreneurs, employees, and students.

Citing figures from the National Statistics Office, Bengco noted that on average, Filipino men and women can now expect to live until the ages of 77 and 79, respectively, or more than a decade past the mandatory retirement age of 65. “How will you enjoy your dozen more years…if you haven’t managed your personal finances well?” he asked the listening crowd of entrepreneurs, employees, and students.

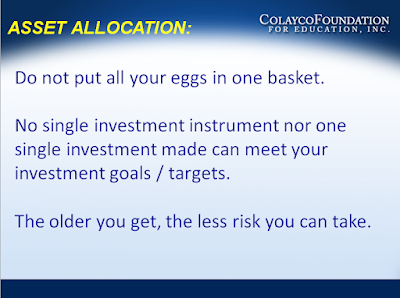

In a booming economy, said Bengco, at least some of your money should be in a “buy” type of investment (e.g. stocks, mutual fund, unit investment trust fund, etc.) rather than a “lend” type of investment (savings deposits, time deposits, government securities, insurance, etc).

Comparing the various financial instruments, their costs and returns, Bengco’s best bet is for you to invest a small amount—as low as P5,000—in a mutual fund, particularly one that has a proven track record. “Stay with the winners…[invest in] any of the top five, and you will not go wrong,” he advised.

Comparing the various financial instruments, their costs and returns, Bengco’s best bet is for you to invest a small amount—as low as P5,000—in a mutual fund, particularly one that has a proven track record. “Stay with the winners…[invest in] any of the top five, and you will not go wrong,” he advised.

The higher the returns, admitted Bengco, the higher the risk. To manage your expectations, he suggested working “on the average,” or looking at the fund’s performance in the long term. “Give it five years and up,” he said. For the past five years, Bengco pointed out, the various types of mutual funds have had solid returns: an average of 16 to 23 percent for equity or stock funds; 13 to 15 percent for balanced funds; and four to 10 percent for fixed income funds.

“Be present in the financial world — have a bank account and then progress into an investment account — and not just your ATM payroll account. Regularly save and invest,” said Bengco.

Did you find the talk interesting and educational? It sure is! But you know what's more exciting about this? It's all for FREE! Yes, you just missed this awesome event!

The Entrepreneur Philippines' ’Trep Talk, dubbed “Money Matters,” featuring Armand Bengco of the Colayco Foundation, was held on April 28 at the Dusit Thani Manila. Regular discussions on entrepreneurship, financial literacy, management, among other topics, are conducted for the exclusive benefit of the magazine’s subscribers and readers.

Do you want to be part of their next event and never miss great learnigs like this again? Visit their official website, and follow them on Facebook or Twitter!

This is a guest post.

Author Bio:

Summit Media is the largest magazine publishing company in the Philippines, with more than 20 titles under its belt to cater to individuals with different lifestyles, attitudes, and passions: Candy, Cosmopolitan, Disney Junior, Disney Princess, Elle Decoration, Entrepreneur, Esquire, FHM, Good Housekeeping, K-Zone, Men’s Health, Preview, Real Living, Smart Parenting, Sparkling, Top Gear, Total Girl, Town & Country, YES!, and YUMMY. Summit Media, for the ninth year in a row topped the nationwide TNS-Trends Newsstand Survey conducted in 2014. Summit Media titles led in all their respective categories, making Summit Media the leading consumer magazine publisher in the Philippines not just in terms of number of titles and advertising sales, but in circulation per category as well. By creating magazines and platforms that are relevant, affordable, and of world-class standards, Summit Media has changed the way Filipinos read.

- o0o -

Did you find the talk interesting and educational? It sure is! But you know what's more exciting about this? It's all for FREE! Yes, you just missed this awesome event!

The Entrepreneur Philippines' ’Trep Talk, dubbed “Money Matters,” featuring Armand Bengco of the Colayco Foundation, was held on April 28 at the Dusit Thani Manila. Regular discussions on entrepreneurship, financial literacy, management, among other topics, are conducted for the exclusive benefit of the magazine’s subscribers and readers.

Do you want to be part of their next event and never miss great learnigs like this again? Visit their official website, and follow them on Facebook or Twitter!

This is a guest post.

Author Bio:

Summit Media is the largest magazine publishing company in the Philippines, with more than 20 titles under its belt to cater to individuals with different lifestyles, attitudes, and passions: Candy, Cosmopolitan, Disney Junior, Disney Princess, Elle Decoration, Entrepreneur, Esquire, FHM, Good Housekeeping, K-Zone, Men’s Health, Preview, Real Living, Smart Parenting, Sparkling, Top Gear, Total Girl, Town & Country, YES!, and YUMMY. Summit Media, for the ninth year in a row topped the nationwide TNS-Trends Newsstand Survey conducted in 2014. Summit Media titles led in all their respective categories, making Summit Media the leading consumer magazine publisher in the Philippines not just in terms of number of titles and advertising sales, but in circulation per category as well. By creating magazines and platforms that are relevant, affordable, and of world-class standards, Summit Media has changed the way Filipinos read.

When will you start taking care of your finances? Receive FREE updates on great articles like this when you subscribe to PisoandBeyond!

|

That is really good post. I am sharing on my blog's facebook page - moneysparkle.com

ReplyDeleteThis is a worth-reading article. That's why my first article on my blog is entitled The best investment that could you more than 1000% return. You can read it here: http://www.thinkpesos.com/best-investment/

ReplyDeleteHi Billy,

DeleteThanks for dropping by! I've read your article and I must say you nailed it. Let's keep it up. ^_^